CFO leadership series

A practical series on modern finance leadership—from moving reactive teams to proactive control, automating for efficiency, and building trust-first spend cultures to leveraging AI and governance for smarter, faster decisions.

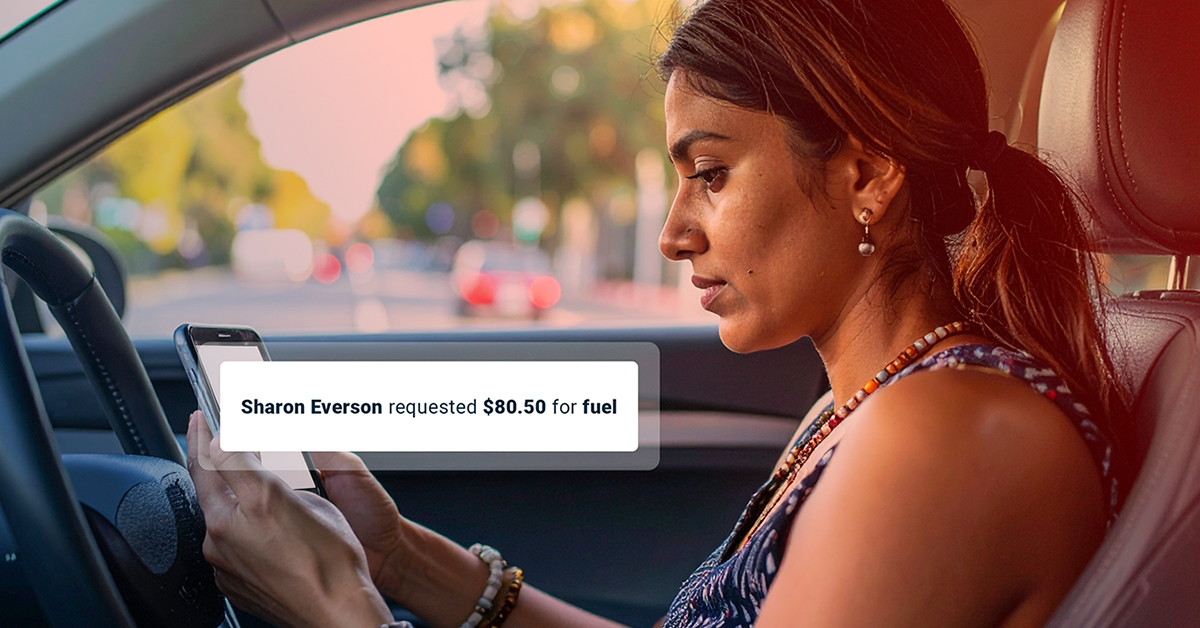

Series 3: Empowering teams, controlling spend – building a trust-first culture

About the Author

Simon Lenoir is the Founder & Chief Executive Officer of Budgetly. A seasoned business leader with a passion for building high-performing teams, Simon brings a practical lens to finance, operations, and technology. He writes regularly about leadership, innovation, and simplifying business systems to drive impact.