Insights

Best practices and tips on spend management, automated expense tracking and corporate debit cards for Australian SMB and enterprise businesses.

Statement of financial performance: A complete guide for small to medium businesses

Ever wondered whether your business is performing as well as it feels? Your Statement of Financial Performance holds the answer. It's the financial pulse check that shows how efficiently your business turns income into profit.

While many Australian business owners focus on cash flow or monthly sales figures, the Statement of Financial Performance reveals something deeper. It's whether your business is actually building sustainable wealth or just moving money around. This is the difference between feeling busy and being profitable.

In this guide, we'll break down exactly what a Statement of Financial Performance is, how to interpret it for real-world decisions, and why it matters for small to medium Australian businesses. We'll also explore how modern finance tools like Budgetly help you stay on top of it with automated tracking and real-time insights.

Let's dive into the financial statement that shows whether your hard work is truly paying off.

What is a statement of financial performance?

A Statement of Financial Performance is a financial report that summarises your business's income, expenses, and profit over a specific period. Typically monthly, quarterly, or annually. Think of it as your business's report card, it shows exactly how much money came in, how much went out, and what was left over.

You might also hear it called a Profit and Loss Statement (P&L) or, more formally, a Statement of Comprehensive Income under Australian Accounting Standards Board (AASB) guidelines. Regardless of the name, its purpose remains the same. To provide clear visibility into your business's financial efficiency.

Modern businesses often use corporate cards and virtual cards to streamline expense tracking, making it easier to categorise and record business expenses accurately in their Statement of Financial Performance. These payment tools can automatically integrate with accounting systems, ensuring all business expenditures are properly captured and reported.

How it differs from other financial statements

Unlike a balance sheet, which shows what you own and owe at a single point in time, the Statement of Financial Performance tracks movement over time. While a cash flow statement shows money moving in and out of your bank account, this statement focuses on earned revenue and incurred expenses, even if the cash hasn't changed hands yet.

This distinction matters because it reveals whether your business model is fundamentally profitable, not just whether you have cash in the bank right now. Using corporate cards and virtual cards can help maintain accurate expense records by providing detailed transaction data that feeds directly into your financial performance reporting, ensuring nothing falls through the cracks.

Components of a statement of financial performance

Understanding each element of your Statement of Financial Performance is crucial for making informed business decisions. Let's break down the key components:

Revenue (income earned)

This represents all income your business has earned during the reporting period, including:

- Sales of products or services

- Interest income

- Rental income (if applicable)

- Other operating income

Important note: Revenue is recorded when earned, not necessarily when cash is received.

Expenses

These are all costs incurred to generate that revenue:

- Cost of Goods Sold (COGS): Direct costs like inventory, materials, or direct labour

- Operating Expenses: Rent, utilities, wages, marketing, insurance, software subscriptions

- Administrative Expenses: Accounting fees, legal costs, office supplies

- Depreciation: The decline in value of business assets over time

Gross profit

Revenue minus Cost of Goods Sold. This shows how efficiently you're producing your core product or service.

Net profit or loss

The final result after all expenses are deducted from revenue. This is the true measure of your business performance during the period.

Other comprehensive income

Less common for small businesses, this includes items like asset revaluations or foreign exchange gains that fall outside everyday operations.

Simple example: Harbour café Pty Ltd (monthly statement)

| Item | Amount |

|---|---|

| REVENUE | |

| Food and beverage sales | $45,000 |

| Catering services | $8,000 |

| TOTAL REVENUE | $53,000 |

| EXPENSES | |

| Cost of goods sold (ingredients) | $18,000 |

| GROSS PROFIT | $35,000 |

| OPERATING EXPENSES | |

| Wages | $15,000 |

| Rent | $4,500 |

| Utilities | $800 |

| Marketing | $1,200 |

| Insurance | $600 |

| Other operating expenses | $2,400 |

| TOTAL OPERATING EXPENSES | $24,500 |

| NET PROFIT | $10,500 |

|

Access free Budgetly tools to reduce admin and improve expense tracking. |

Why a statement of financial performance matters

Your Statement of Financial Performance isn't just a compliance document, it's a strategic tool that impacts every aspect of your business. Here's why Australian SME owners should prioritise understanding it:

A. It reveals the true health of your business

Many businesses feel successful when sales are growing, but the Statement of Financial Performance shows whether that growth is sustainable. If your revenue is increasing but your profit margins are shrinking, you might be working harder for less return.

Regular review of this statement helps you see beyond the day-to-day cash movements to understand long-term profitability trends. It's particularly valuable for spotting when costs are creeping up faster than revenue.

B. It informs smarter business decisions

Every major business decision should be informed by financial performance data:

- Pricing strategies: Are your margins healthy enough to support growth?

- Staffing decisions: Can you afford that new hire, or should you focus on efficiency?

- Product focus: Which products or services are most profitable?

- Cost management: Where are you overspending, and what can be optimised?

Instead of making decisions based on gut feeling, you can use concrete profit data to guide your strategy.

C. It strengthens credibility and growth potential

Lenders, investors, and potential partners want to see consistent profitability before they'll back your business. A strong Statement of Financial Performance demonstrates:

- Financial stability and management competence

- Sustainable business model

- Growth potential and scalability

This credibility can be the difference between securing that business loan or investment round.

D. It supports better cash flow and budgeting

While profit and cash flow are different, understanding your financial performance helps identify timing mismatches between earning revenue and receiving payment. This insight improves:

- Forecasting accuracy, especially for seasonal businesses

- Budget planning and spending controls

- Working capital management

E. It Reinforces compliance and transparency

Australian businesses must meet AASB reporting standards, and maintaining accurate Statements of Financial Performance ensures:

- Compliance with regulatory requirements

- Simplified tax planning and lodgement

- Audit readiness if required

- Internal accountability and governance

How it links to other financial statements

Your Statement of Financial Performance doesn't exist in isolation, it connects directly to your other financial reports:

Connection to Balance Sheet: Net profit from your Statement of Financial Performance flows into retained earnings on your balance sheet, increasing your equity.

Connection to Cash Flow Statement: While your Statement of Financial Performance shows profit, your cash flow statement shows how that profit translates to actual cash movement, accounting for timing differences in receipts and payments.

Example Connection:

If Harbour Café shows $10,500 profit but customers haven't paid $5,000 in outstanding invoices, the cash flow statement will show less cash received than profit earned.

Key ratios to measure financial performance

Raw numbers tell part of the story, but ratios provide context and comparability. Here are the most useful ratios for Australian SMEs:

| Ratio | Formula | What it Shows | Harbour Café Example |

|---|---|---|---|

| Gross Profit Margin | (Revenue - Cost of Goods Sold) ÷ Revenue × 100 | How efficiently you produce your core product or service | ($53,000 - $18,000) ÷ $53,000 × 100 = 66.0% |

| Net Profit Margin | Net Profit ÷ Revenue × 100 | Overall business efficiency after all costs | $10,500 ÷ $53,000 × 100 = 19.8% |

| Return on Assets (ROA) | Net Profit ÷ Total Assets × 100 | How effectively your assets generate income |

|

| Return on Equity (ROE) | Net Profit ÷ Owner's Equity × 100 | Return on owner investment | — |

| Current Ratio | Current Assets ÷ Current Liabilities | Ability to cover short-term obligations | — |

The Harbour Café example demonstrates healthy margins with a 66% gross profit margin and nearly 20% net profit margin, indicating efficient operations. Understanding and accurately preparing a financial statement is crucial for assessing financial health, making informed decisions, and ensuring compliance with financial regulations.

These are some accounting essentials every SME business should know as they help identify areas for improvement in your business operations.

Common financial performance mistakes to avoid

Automation and AI driving efficiency

Artificial intelligence is transforming routine accounting tasks. Modern systems can automatically categorise expenses, predict cash flow, and even suggest tax deductions based on your spending patterns.

Banking and accounting convergence

The lines between banking and accounting are blurring. Many accounting platforms now offer payment processing, lending services, and business banking features, creating all-in-one financial hubs.

Mobile-first business management

Smartphones are becoming primary business tools. The best cloud accounting platforms prioritise mobile functionality, allowing you to run your finances entirely from your phone when needed.

Bundled services

Rather than juggling multiple providers, many businesses prefer integrated suites combining accounting, payroll, tax preparation, and business advisory services under one umbrella.

How to analyse and improve financial performance

Reading your Statement of Financial Performance is just the first step. Here's how to turn insights into action:

Compare performance over time

Look at trends across multiple periods:

- Is revenue growing consistently?

- Are margins improving or declining?

- Which expenses are growing fastest?

Track margins by product or service

If you offer multiple products or services, calculate separate profit margins to identify your most and least profitable offerings.

Benchmark against industry averages

Research typical profit margins for your industry to understand whether your performance is competitive.

Identify recurring cost overruns

Look for expenses that consistently exceed budget or grow disproportionately to revenue.

Review and refine monthly

Don't wait until year-end. Monthly reviews allow you to spot problems early and make timely adjustments.

The key to continuous improvement is having real-time visibility into your financial performance, not just historical reports. This is where automation tools become invaluable for ongoing accuracy and immediate insights.

Example walkthrough: Harbour café analysis

Let's revisit our Harbour Café example and analyse what the owner might conclude:

Strengths:

- Strong gross profit margin (66.0%) indicates efficient kitchen operations

- Healthy net profit margin (19.8%) shows good overall cost control

- Diversified revenue streams (café sales + catering)

Areas for investigation:

- Wages represent 28% of revenue — is this sustainable as minimum wages increase?

- Marketing spend is only 2.3% of revenue — could increased marketing drive more profitable growth?

- No depreciation shown — are equipment replacement costs being planned for?

Potential actions:

- Compare wage costs to industry benchmarks

- Test increased marketing spend with measurable ROI targets

- Create a depreciation schedule for equipment planning

This analysis transforms raw numbers into actionable business insights.

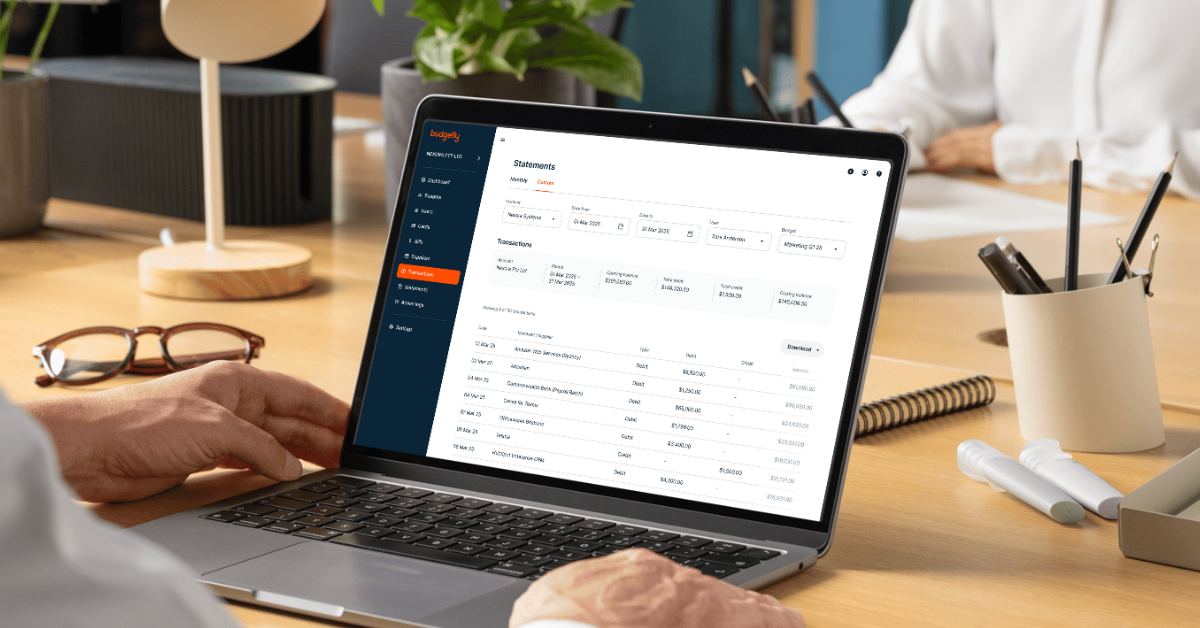

Bring financial clarity to life with Budgetly

Understanding financial performance is one thing, managing it daily is another. That's where Budgetly helps Australian businesses take control.

Traditional financial statements show you what happened last month or last quarter. But what if you could see your financial performance in real-time and take immediate action to improve it?

Budgetly's AI-driven spend management platform enables SMEs to:

- Automate expense management through our intelligent expense management system, ensuring every cost is captured and categorised correctly

- Gain real-time visibility with smart expense tracking and instant budget insights that show you exactly where your money is going as it happens

- Set spending limits and manage team budgets via intuitive corporate cards and secure virtual cards, preventing cost overruns before they impact your profit margins

- Simplify supplier payments through streamlined bill payments and intelligent budget management software

- Integrate seamlessly with accounting tools using our Xero integration, ensuring your Statement of Financial Performance is always accurate and up-to-date

Instead of waiting for month-end reports to see if you've overspent, Budgetly gives you live insights that help you optimise financial performance as it happens. Every expense approval, every budget alert, and every spending decision becomes an opportunity to improve your bottom line.

Your Statement of Financial Performance shows what's happening.

Budgetly helps you act on it, giving you live insights, automated tracking, and total control over every dollar your business spends.

Compliance and reporting

Maintaining accurate, real-time financial records isn't just good business practice, it's essential for meeting Australian compliance requirements. The Australian Accounting Standards Board (AASB) requires businesses to maintain proper financial records, and your Statement of Financial Performance is a cornerstone of this obligation.

Modern automation tools make compliance significantly easier by:

- Reducing manual data entry and human error

- Providing audit trails for all transactions

- Ensuring consistent categorisation of income and expenses

- Generating reports that meet AASB formatting requirements

- Simplifying tax preparation and lodgement

When your expense tracking and budget management are automated, your Statement of Financial Performance becomes more accurate, timely, and compliant, giving you confidence in both your regulatory standing and your business insights.

Taking control of your financial performance

Your Statement of Financial Performance is more than just an accounting document, it's your roadmap to sustainable business growth. It reveals whether your hard work is translating into real profit, whether your costs are under control, and where you should focus your energy for maximum impact.

But understanding your financial performance is only the beginning. In today's competitive business environment, the companies that thrive are those that can see their financial position in real-time and make immediate adjustments to stay on track.

When you understand your financial performance, you gain clarity.

When you automate it with Budgetly, you gain control.

Your Statement of Financial Performance shows you the destination; tools like Budgetly help you navigate the journey with confidence, precision, and success.

Start taking control of your financial performance today. Because when you know where every dollar goes, you can make sure every dollar counts.

Ready to improve your financial performance and reduce admin across your team?

Schedule a demo with us today, or watch a 10-minute recorded demo!