Insights

Best practices and tips on spend management, automated expense tracking and corporate debit cards for Australian SMB and enterprise businesses.

The essential accounts payable (AP) automation guide for Australian businesses

AP automation is the use of software to capture invoices, match them to POs or receipts, route approvals, schedule payment, and reconcile transactions. It reduces manual data entry and errors, shortens invoice cycle times, improves fraud controls, and gives finance teams real-time visibility of spend and liabilities.

Why it matters? Manual invoice processing costs Australian businesses $15-25 per invoice and takes 7-14 days on average. AP automation cuts this to $3-8 per invoice in 1-3 days, while reducing fraud risk by 60%.

- Benefits and ROI of AP automation

- AI in AP automation

- Implementation best practice

- The Budgetly playbook: Cards and AP working together

- Frequently asked questions

How AP automation works: Step by step

Understanding the AP automation workflow helps you see where the biggest time savings happen.

1. Invoice capture and data extraction

Modern AP systems capture invoices from multiple channels: email, EDI, supplier portals, or mobile uploads. OCR (Optical Character Recognition) and AI extract key data including:

- Supplier name and ABN

- Invoice number and date

- Line items and amounts

- Tax codes and GST amounts

- Purchase order references

The system validates extracted data against your vendor master file and flags inconsistencies like missing ABNs or incorrect GST codes.

2. Matching and validation

This is where AP automation delivers major efficiency gains:

Two-way matching compares invoice details against the original purchase order. It's ideal for services and low-risk purchases where goods receipt isn't critical.

Three-way matching adds goods receipt data, comparing invoice, PO, and delivery confirmation. This provides stronger controls for inventory and high-value items.

Most systems allow tolerance settings (typically 5-10% for price variances) to handle minor discrepancies without stopping the workflow.

3. Approval workflows

Intelligent routing sends invoices to the right approvers based on:

- Invoice amount and approval limits

- Vendor category or risk rating

- Cost centre or department

- Exception handling rules

Approvers get notifications with invoice images, PO details, and mobile-friendly approval options.

4. Payment execution and scheduling

Once approved, invoices join payment runs based on:

- Payment terms and early payment discounts

- Cash flow forecasts

- Preferred payment methods

The system generates payment files for your bank or processes payments directly through integrated payment rails.

5. Reconciliation and reporting

Automated bank feeds match payments to invoices, while real-time dashboards show:

- Outstanding liabilities by due date

- Early payment discount opportunities

- Approval bottlenecks and cycle times

- Spend analysis by vendor and category

Tasks you can automate today

Start with these high-impact automations that deliver immediate time savings:- Data entry elimination removes 80% of manual keying through accurate OCR and smart field mapping.

- Invoice coding rules automatically apply GL codes based on vendor, description keywords, or cost centres.

- Duplicate detection flags potential duplicates by matching invoice numbers, amounts, and dates across suppliers.

- ABN validation automatically checks supplier ABNs against the ATO registry and flags invalid or missing numbers.

- GST code application applies correct tax codes based on invoice type, supplier registration, and line item categories.

- Payment reminders send automated notifications to suppliers about payment status and expected dates.

- Accrual automation creates month-end accruals for approved but unpaid invoices.

- Statement reconciliation matches supplier statements against your AP ledger to identify discrepancies.

|

Access free Budgetly tools to reduce admin and improve expense tracking. |

Benefits and ROI of AP automation

Calculate your potential savings

Baseline measurement: Start with your current invoices per month, all-in cost per invoice (including staff time), and average processing cycle time.

Target improvements: AP automation typically reduces cost per invoice by 60-70% and cuts cycle time by 50-80%.

Example calculation: If your cost per invoice drops from $15 to $5 processing 2,000 invoices monthly, that's $20,000 in monthly savings ($240,000 annually), plus early payment discount opportunities.

Key benefits beyond cost savings

Faster cycle times mean better supplier relationships and more early payment discounts captured.

Fewer errors reduce time spent on invoice queries and corrections.

Clean audit trails provide complete visibility from receipt to payment with automated compliance reporting.

Better cash flow visibility through real-time liability reporting and payment forecasting.

Stronger fraud controls with segregated approvals, duplicate detection, and automated validation checks.

AI in AP automation

Artificial intelligence is transforming AP beyond basic OCR:

- Smart coding learns from your historical data to suggest GL codes and cost centres for new invoices.

- Anomaly detection flags unusual patterns like price spikes, new vendors, or off-cycle invoices.

- Touchless processing rates of 70-85% are now achievable for standard invoices with good master data.

- Conversational queries let you ask questions like "What did we spend on marketing in Q2?" and get instant answers from your AP data.

Digital payment options in Australia

| Payment Method | Cost | Speed | Fraud Risk | Reconciliation |

|---|---|---|---|---|

| BECS Direct Entry | Low | 1-2 days | Medium | Manual |

| PayTo | Low | Real-time | Low | Automated |

| Real-time Payments (NPP) | Medium | Instant | Medium | Automated |

| Wire Transfer | High | Same day | Low | Manual |

| Virtual Cards | Medium | Instant | Very Low | Automated |

Virtual cards are particularly valuable for AP automation. They provide unique card numbers for each payment, automatic reconciliation data, and the ability to set spending controls by vendor and amount.

How to choose AP automation software

Key evaluation criteria

Processing volumes determine whether you need enterprise-grade systems or can use SME-focused solutions.

Integration requirements are critical. For Australian businesses, prioritise solutions with deep, real-time integration rather than basic data exports.

Security features should include role-based access, audit logging, and SOC 2 compliance as minimum requirements.

Implementation model varies from self-service cloud solutions to fully managed implementations. Choose based on your IT resources and timeline.

Local support matters for Australian compliance requirements and time zone coverage.

Key considerations

Australian SMEs should prioritise:

- Real-time chart of accounts sync

- Automatic GST code mapping

- Bank feed integration

- Multi-entity support for group reporting

- Mobile approval capabilities

Implementation best practice

Phase 1: Foundation setting

Map your current state by documenting existing workflows, approval hierarchies, and pain points.

Clean up policies by defining clear approval limits, vendor onboarding processes, and exception handling rules.

Fix vendor master data by ensuring complete ABNs, correct bank details, and proper categorisation.

Phase 2: Phased rollout

Start with a single entity or department to prove the process works before expanding.

Change management is crucial. Train approvers on mobile workflows and set clear expectations about response times.

User acceptance testing should cover exception scenarios like mismatched POs and duplicate invoices.

Phase 3: Optimisation

Monitor touchless rates and cycle times monthly. Adjust coding rules and tolerances based on actual results.

Build feedback loops with suppliers on payment timing and remittance information quality.

Common use cases and quick wins

Multi-entity and service businesses see the fastest AP automation wins. Operations with multiple subsidiaries benefit from standardised workflows that roll up into centralised reporting, giving finance teams consistent processes across all entities. Service-heavy businesses with few purchase orders get immediate value from automated invoice coding and smart approval routing, eliminating the manual work of categorising and routing supplier bills.

Inventory-focused and remote businesses solve different challenges through automation. Companies managing physical goods gain powerful control through three-way matching that automatically compares invoices, purchase orders, and goods receipts before payment. Meanwhile, businesses with remote approval processes find that mobile-friendly interfaces and automated email notifications keep invoices moving smoothly, regardless of where approvers are located.

ANZ compliance checklist for AP automation

If you operate in Australia or New Zealand, make sure your AP stack supports Peppol eInvoicing, ABN validation, the right GST codes, and local payment rails like BECS and PayTo. This cuts errors and keeps you audit-ready.

Essential compliance features

☐ Peppol eInvoicing ready for government and large enterprise suppliers mandating electronic invoicing.

☐ ABN validation automatically checks supplier ABNs against ATO records and flags invalid entries.

☐ GST codes applied correctly with documented tax rounding rules matching ATO requirements.

☐ BECS bank file support for bulk payment processing through Australian banking systems.

☐ PayTo integration for faster, more secure payment settlement.

☐ Document retention aligned to ATO requirements with secure storage and audit trail preservation.

☐ Access controls including role-based permissions, SSO integration, and comprehensive event logging.

ABN validation as a control

ABN checking reduces fraud risk by verifying supplier legitimacy and prevents duplicate vendor records from similar business names. It also ensures correct GST treatment and supports automated ATO reporting requirements.

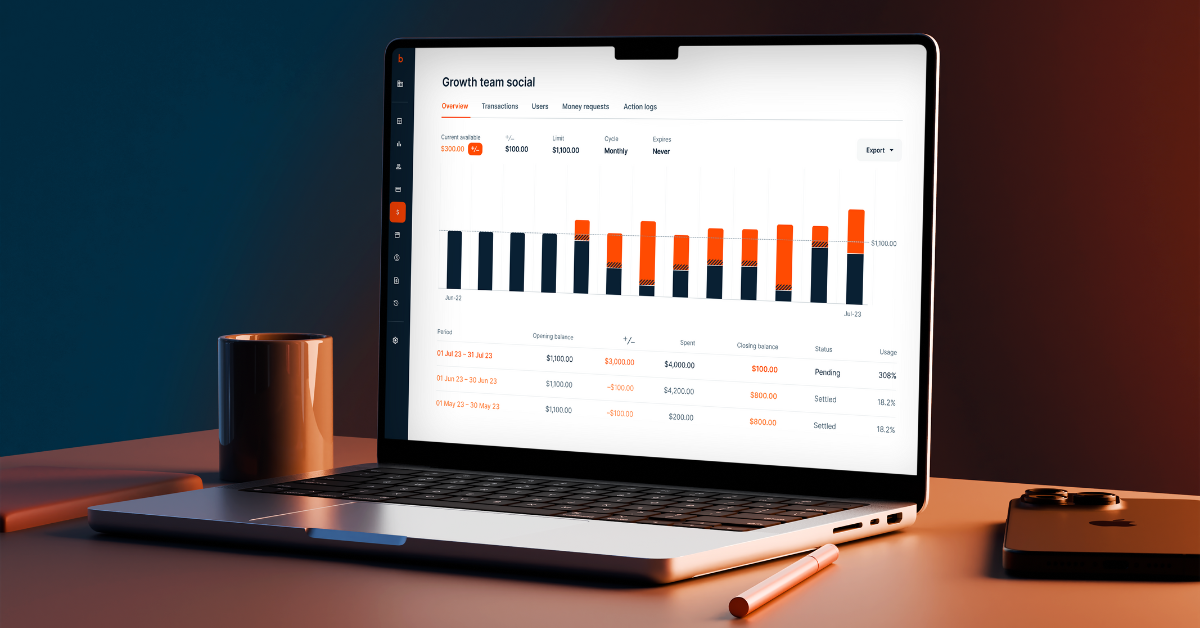

The Budgetly playbook: Cards and AP working together

Bring AP and cards under one policy. Use Budgetly's policy-based corporate card controls and route the remaining invoices through AP automation. The result is fewer invoices, faster close, and cleaner data.

Integrated spend management strategy

Policy-based card controls set spending limits by vendor, category, and amount before purchases happen.

Point-of-spend data capture pushes receipts and expense notes directly from card transactions, reducing AP exceptions through streamlined expense management.

Strategic AP usage focuses on invoices requiring matching and approval workflows, rather than processing every expense.

Virtual card payments handle vendor invoices where appropriate, improving control and simplifying reconciliation.

Unified month-end close provides single source of truth across all spending channels.

Results you can expect

- 40-60% reduction in invoices entering AP workflows

- Lower cost per transaction across all spending

- Faster month-end close with automated coding

- Real-time spend visibility and better budget control

Frequently asked questions

What is AP automation?

AP automation uses software to digitise and streamline accounts payable processes, from invoice receipt through payment and reconciliation.

How does AP automation differ from AR automation?

AP automation handles incoming bills and payments to suppliers, while AR automation manages customer invoicing and collections.

Do I need an ERP to use AP automation?

No, many AP automation solutions integrate with accounting systems like Xero and MYOB.

However, ERP integration can provide additional workflow capabilities.

How does AP automation prevent fraud?

Through segregated approval workflows, duplicate detection, automated validation checks, and complete audit trails that make unauthorised changes visible.

What is a touchless rate?

The percentage of invoices processed without manual intervention, typically 70-85% for businesses with clean master data and well-configured rules.

How do GST and multi-currency invoices work?

Modern systems automatically apply correct GST codes based on supplier registration and line items, while multi-currency invoices are converted using current exchange rates.

How long does implementation take?

Basic implementations take 2-4 weeks, while complex multi-entity rollouts may require 8-12 weeks including testing and training.

Getting started with AP automation doesn't require a massive transformation. Focus on your highest-volume, most standardised processes first. The time savings and improved control will build momentum for broader automation across your finance operations.

Whether you choose a standalone AP solution or an integrated spend management platform like Budgetly, the key is starting with clean data, clear policies, and realistic expectations about the change management required.

Your finance team will thank you for the time saved, your suppliers will appreciate faster payments, and your auditors will love the complete digital trail.

Ready to improve your financial performance and reduce admin across your team?

Schedule a demo with us today, or watch a 10-minute recorded demo!