Insights

Best practices and tips on spend management, automated expense tracking and corporate debit cards for Australian SMB and enterprise businesses.

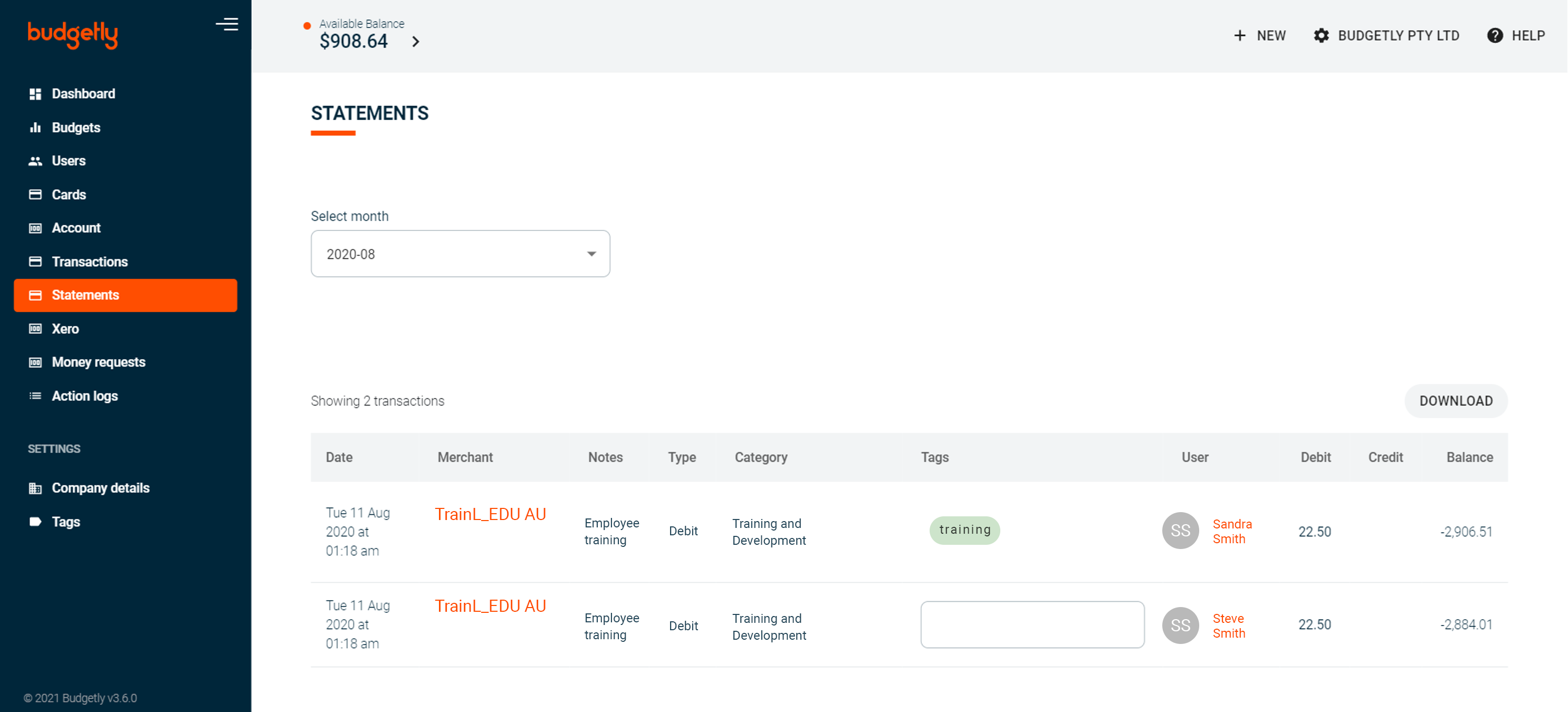

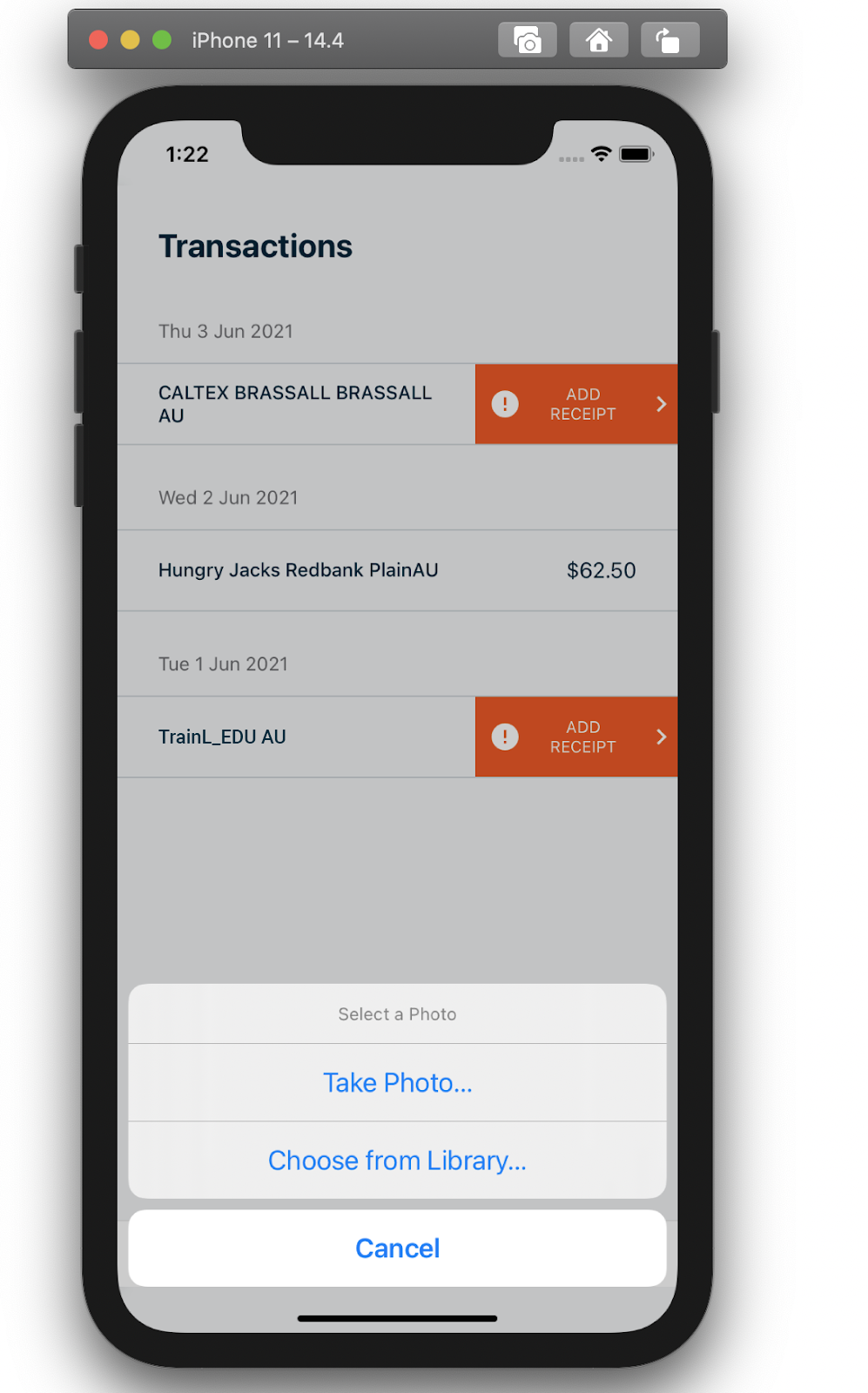

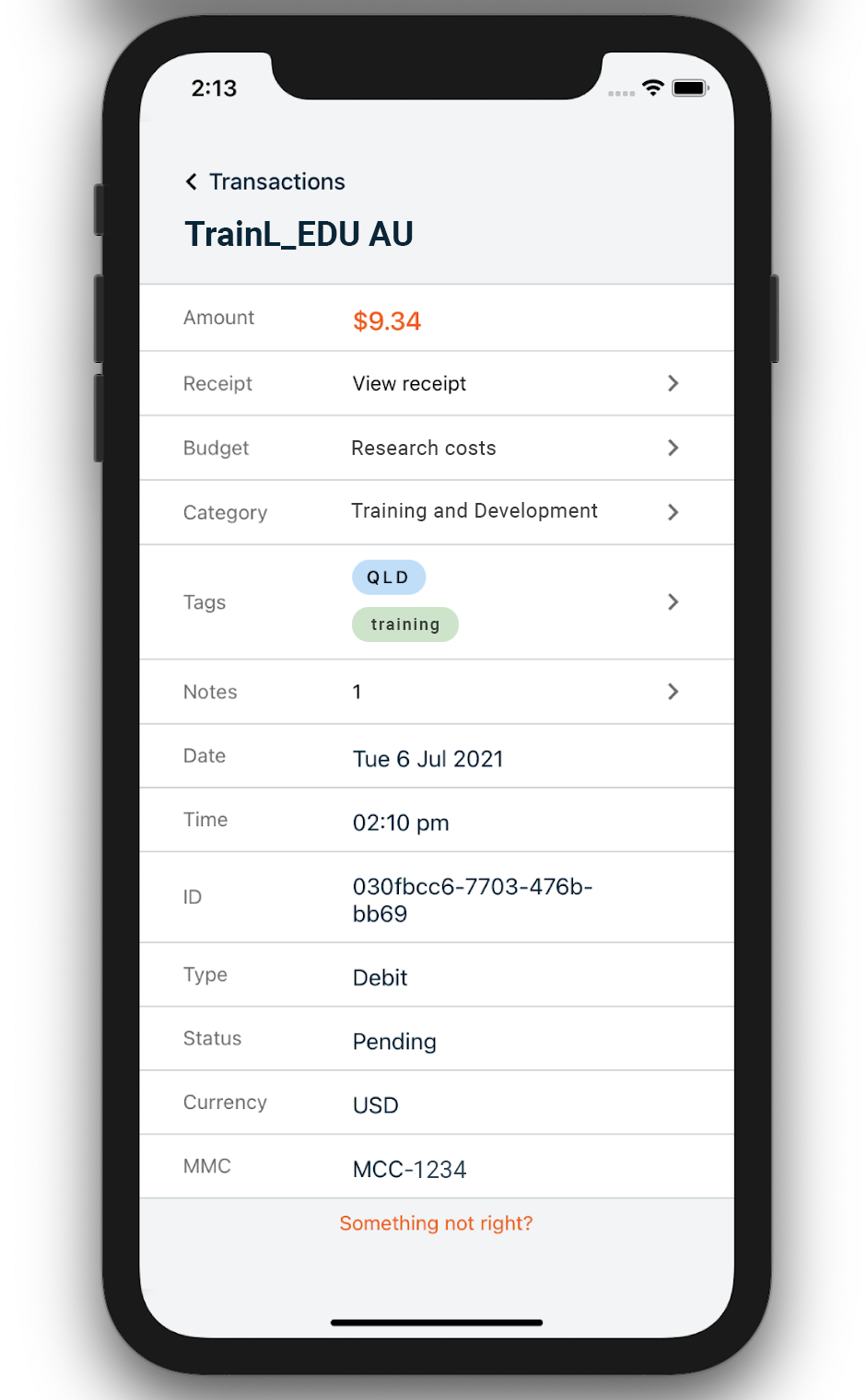

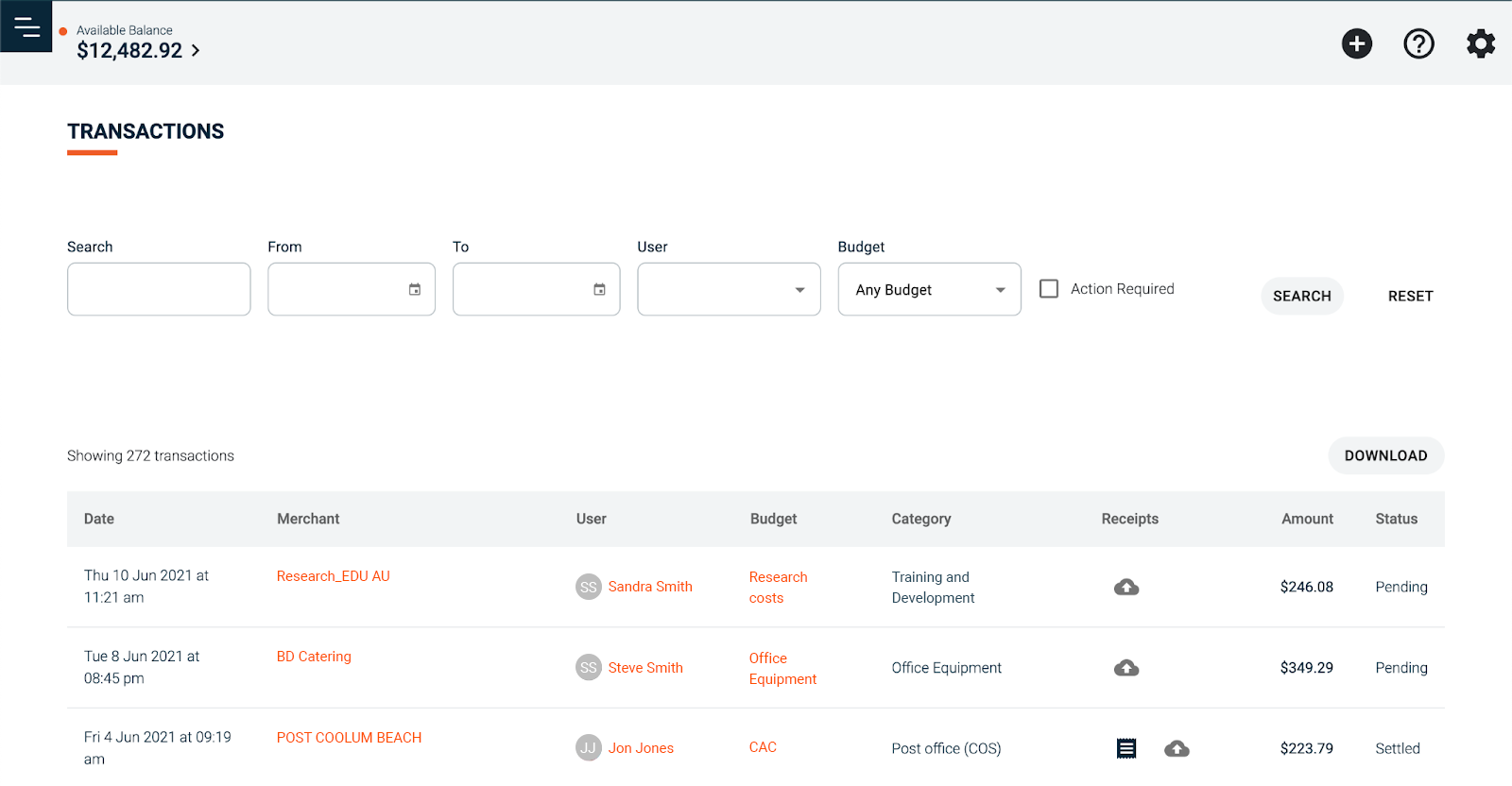

Each year, most not-for-profit and charity organisations are required to undergo audits as a requirement by The Australian Charities and Not-for-profit Commission (ACNC). Most non-profit employees would be familiar with the experience of working last-minute to compile and cross-check the necessary documents, including getting all finance documents ready. But did you know that most of this manual work could be easily solved with Budgetly? Here’s how.