Insights

Best practices and tips on spend management, automated expense tracking and corporate debit cards for Australian SMB and enterprise businesses.

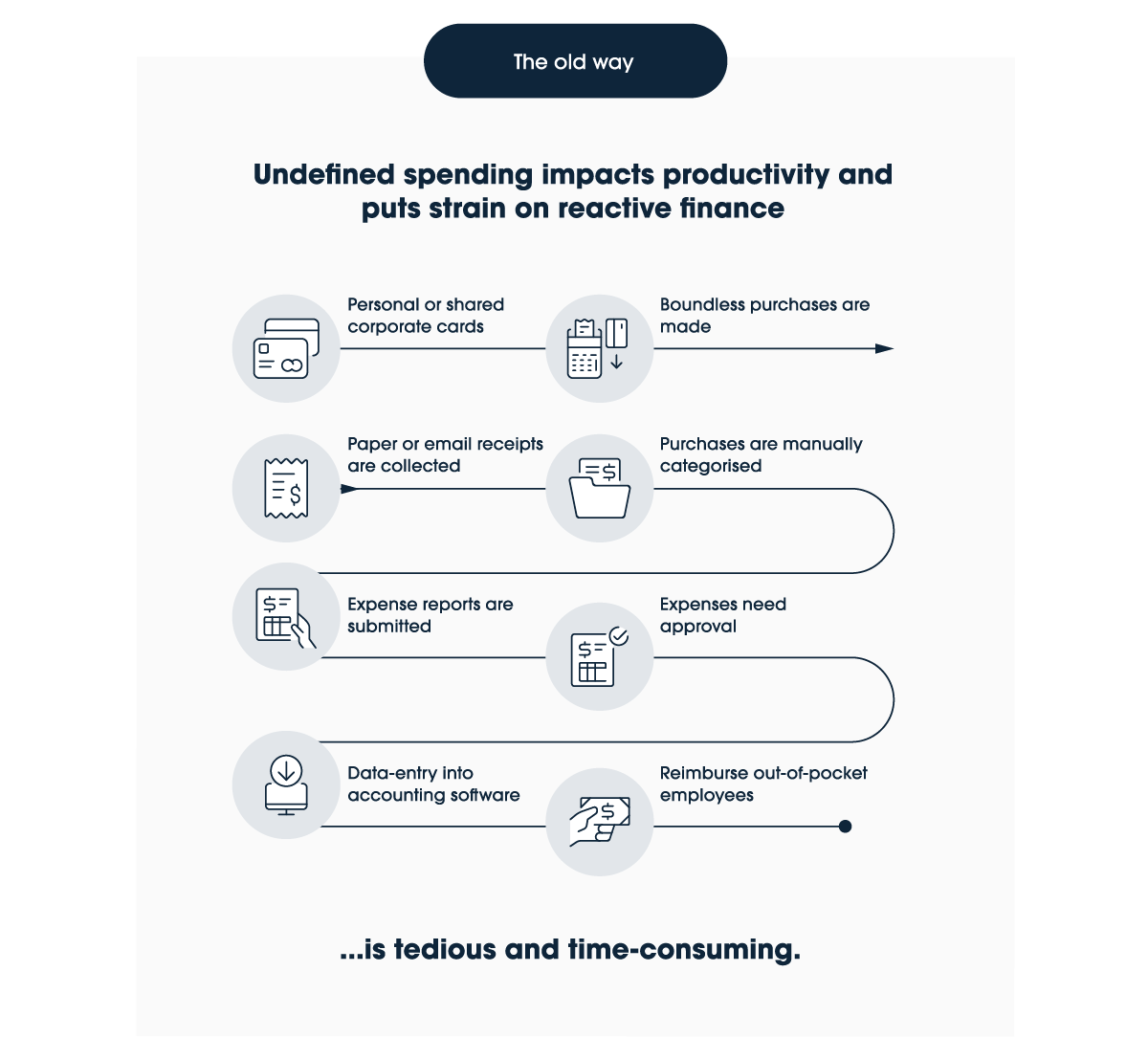

If your business is manually collecting receipts from your staff, you are unknowingly wasting too much time and money.

In this article, we will highlight our top 4 reasons why managing your receipts manually is a bad idea, and how it’s hurting your company more than you know.

-1.png.jpg)