Insights

Best practices and tips on spend management, automated expense tracking and corporate debit cards for Australian SMB and enterprise businesses.

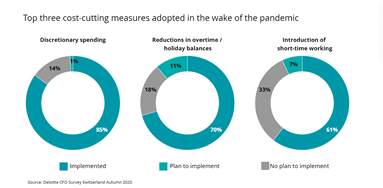

Business owners often don't think about cost-cutting unless necessary. However, with rising supply prices, less consumer spending, and chances of incoming inflation, it’s time businesses get proactive about being savvy with company money.