Case Studies

Delighted Budgetly customers share their simplified business expense management successes!.

Connecting Families save over $21,000 by switching to Budgetly

“Wonderful experience with Help and Support - the focus is very much on the customer!”

Stanley Tang, Finance Manager

Overview

Connecting Families partners with state and federal agencies to provide care and support to families in various locations, improving their quality of life and experiences. They have a successful track record and prioritise collaborative relationships with the community.

To manage expenses, Connecting Families used a mixture of credit cards from banks, creating many challenges.

Challenges-

Manual administration burden: The old process of manually reconciling credit card statements and coding each transaction with checks for receipts caused delays every month due to the complicated administrative tasks involved in closing the books.

-

No real-time visibility: The lack of real-time data on the banking portal at CBA made it difficult to monitor transactions, causing additional delays.

-

Card issuing difficulties: Card issuance was a major challenge, leading Connecting Families to buy Woolworths/Coles vouchers and fuel cards to expedite fund distribution to staff, resulting in wasted time and money.

-

Missing receipts: Staff had difficulty uploading receipts at the point of purchase, leading to delays as finance staff had to monitor and chase for missing receipts, adding more delays to the month-end process.

Results

1. Massive reduction to admin time

Transactions are real-time for all cards, allowing staff to easily upload receipts on the go and code transactions for one-click reconciliation in Xero.

“The impact on our business caused by the delays with our old process was huge. This has now been reduced by 90%.”

Stanley Tang, Finance Manager

2. Real-time visibility on ALL transactions

Real-time transaction details, including who spent the funds, budget allocation, accounting codes, receipts, and GST information, are all available.

"We’ve saved twenty one thousand dollars because now, everything goes through Budgetly."

Stanley Tang, Finance Manager

3. Instant card issuance

A huge benefit of using Budgetly was that Connecting Families can instantly issue virtual and physical cards to staff members, saving time and eliminating delays.

“Cards are instant and can be issued without delay or having to deal with the bank.”

Stanley Tang, Finance Manager

3. No more missing receipts!

Before Budgetly, missing receipts caused delays and extra workload for the small business. Traditional corporate cards from the bank couldn't solve this issue.

“Budgetly is easy to use and easy to upload receipts. Working with both Apple and Android was important to us and the price was very competitive!”

Stanley Tang, Finance Manager

How Budgetly's instant corporate debit cards blew away bank credit cards for Connecting Families

Budgetly prepaid corporate debit cards are available in physical and digital formats, with virtual cards available instantly upon application. Staff can add Budgetly’s virtual cards to their mobile wallets and use them immediately in any location.

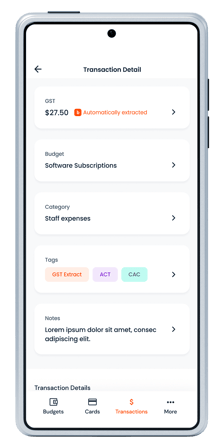

With Budgetly’s preloaded cards, Connecting Families staff can transact, capture their receipts using a smartphone, and upload them to the app. In addition, Budgetly’s expense management software automatically records transaction details such as vendor names and transaction amounts.

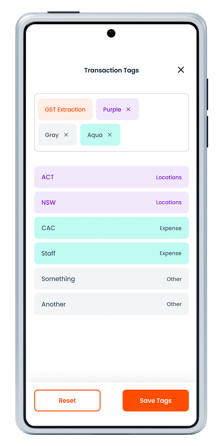

Example of transactions and adding receipts in the Budgetly app

Staff can add notes and assign categories to transactions for easy filtering and viewing based on project or location.

Example of the Budgetly’s transactions view in the app

Finance teams can set card budgets and spending limits to avoid overspending, with automated fortnightly resets or roll-overs.

Example of the Budgetly’s budgeting view

Requesting and approving money top-ups is easy on the Budgetly app, giving finance teams more control over company budgets. Staff transactions can be viewed on the software, providing administrators with greater oversight.

Example of Budgetly’s transaction view

Budgetly offers additional expense management functionalities: |

Issue unlimited Visa debit cards instantly

|

|

Flag unnecessary transactions in real-time

|

Eliminate lost receipts & receipt-chasing |

|

Automatically reconcile transactions

|

Sync all transactions with Xero |

|

Fast transaction reports for audits |

Cancel or freeze cards in one-click |

For more information on Budgetly and how we work for businesses, schedule a demo with us today, or watch a 10-minute recorded demo.

About Connecting Families

Connecting Families works in partnership with state and federal agencies to provide care and support to families in urban, rural and remote locations. Their support services increase the quality of life and experiences for the community.

Connecting Families has a demonstrated track record of success, always striving for a collaborative and positive working relationship in partnership with the community.

About Budgetly

Budgetly is an Australian prepaid corporate card and expense management software provider. We’re committed to making expense management easy for all companies and improving their expense processes. Our service is adopted by many NDIS providers, aged care providers, charities, and businesses across Australia.