Insights

Best practices and tips on spend management, automated expense tracking and corporate debit cards for Australian SMB and enterprise businesses.

As featured on The Educator Australia

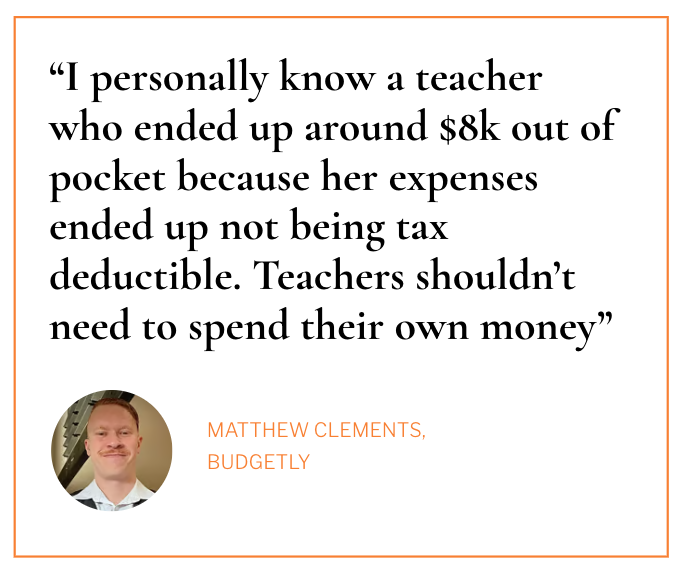

For teachers, there’s nothing worse than having to spend your own money on school excursions and wait days for reimbursement. Fortunately, there’s now a better way to manage school finances.

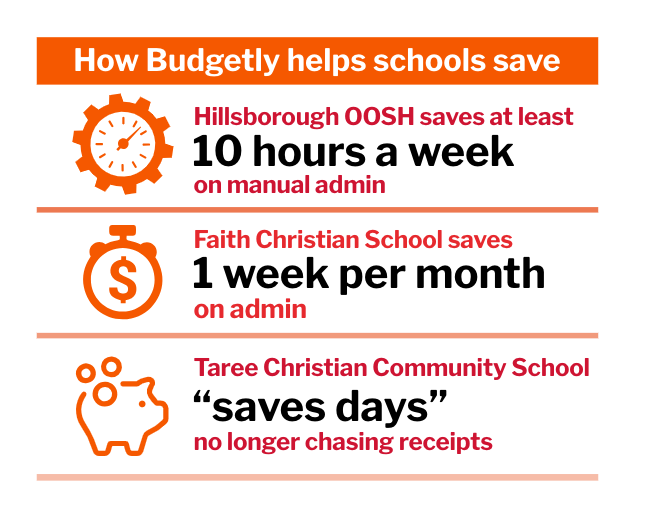

By 2020, the company was up and running with one of its first customers on board – the Public Trustee of Queensland. This led Budgetly to more businesses that work with the Department of Social Services, and it began working with a number of not-for-profits and schools. Today, the company has a strong presence in Australia’s education sector and has helped over 100 schools and 1,100 customers with their budgeting and expenditure.

By 2020, the company was up and running with one of its first customers on board – the Public Trustee of Queensland. This led Budgetly to more businesses that work with the Department of Social Services, and it began working with a number of not-for-profits and schools. Today, the company has a strong presence in Australia’s education sector and has helped over 100 schools and 1,100 customers with their budgeting and expenditure.