About Cooinda Terang Inc

Cooinda is a registered NDIS provider operating in the Terang, Camperdown community for over 50 years. The organisation provides services such as in-home community-based support, fully supported residential care and community participation and lifestyle programs.

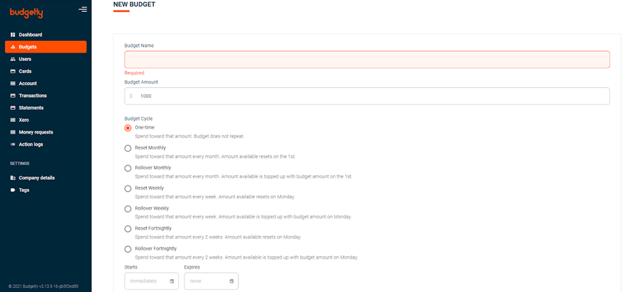

About Budgetly

Budgetly is an Australian prepaid corporate card and expense management software provider. We’re committed to making expense management easy for all companies and improving their processes. Our service is adopted by many NDIS service providers, aged care providers, charities, and businesses across Australia.