Financial Advisory Firm has 10 clients making expenses a breeze using Budgetly!

“Budgetly is so much more user friendly than other options out there! We’d definitely recommend Budgetly to other bookkeepers and accountants.”

Sheila Ryan, Head of Financial Operations

Overview

Founded in 1993, Bourke Group is an award winning boutique firm with approximately 60 staff based in Melbourne and regional Victoria. Their core services include Virtual CFO & Family Office Services, HNW Wealth Management and Corporate Advisory.

They have a wide range of clients including businesses in advertising, day spa, construction, super yacht charters, digital marketing, sportswear apparel, hospitality, retail and solar energy that they support with bookkeeping and accounting services.

Bourke Group recommends Budgetly to their clients who are experiencing headaches with expense management. To manage expenses prior to Budgetly, Bourke Group’s clients used a mixture of credit cards and debit cards from the banks. It was usually one or two sitting with the owner(s) that ended up being shared around.

Across ten of these businesses, the challenges were starting to mount and included:

- Manual administration burden: The entire process was quite manual for us at Bourke group and “clunky” for the end users (employees at each business) It just wasn’t that user friendly for all involved.

- Lack of real-time visibility: It was very hard to monitor the transactions throughout the month as the banking portal(s) did not provide live data. This added to the manual admin needed to help each business.

- Difficulty in issuing cards: The businesses all have their own ratio of staff turnover. Some regular (such as yacht charters where an employee would only be employed for that particular charter) and some irregular. Nonetheless, when a new card needed to be issued, the banks would not deal with us directly even though we were an authorised representative of the business. This process was very clunky and involved a lot of back and forth between multiple parties.

- Chasing receipts and other transaction info: There wasn’t really an easy way for staff to upload receipts at the point of purchase or code the transaction or even put a small description of what the transaction was for. Trying to monitor for missing receipts across multiple staff, multiple cards and multiple businesses was a nightmare.

Budgetly Solution

Budgetly prepaid corporate debit cards are available in physical and digital formats, with virtual cards available instantly upon application. Staff can add Budgetly’s virtual cards to their mobile wallets and use them immediately in any location.

With Budgetly’s preloaded cards, Bourke Group staff can transact, capture their receipts using a smartphone, and upload them to the app. In addition, Budgetly’s expense management software automatically records transaction details such as vendor names and transaction amounts.

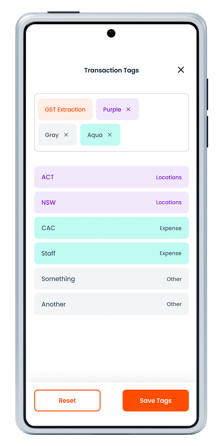

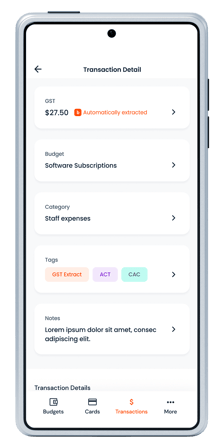

Example of transactions and adding receipts in the Budgetly app

Staff can also add notes to each transaction and assign them under categories and tags set by finance teams. This allows the team to easily filter and view relevant transactions based on project or location.

Example of the Budgetly’s transactions view in the app

Finance teams can allocate budgets for each card and set spending limits to avoid overspending. Additionally, these budgets can be automated to reset or roll over every fortnight.

Example of the Budgetly’s budgeting view

Requesting a money top-up is hassle-free on the app, and finance teams can approve them with a click of a button. In addition, all staff transactions can be viewed on the software, giving administrators more control over company budgets.

Example of Budgetly’s transaction view

Budgetly also provides the following expense management functionalities to staff:

- Cancel or freeze cards with a click of a button

- Instantly issue an unlimited number of Visa debit cards

- Flag any unnecessary transactions with Budgetly’s real-time view

- Eliminate receipt-chasing

- Automatic reconciliation of each transaction

- Sync all transactions with Xero

- Generate easy and quick transaction reports for audits

Results

1. Huge reduction in admin

Budgetly solved a lot of the initial problems that Bourke Group's clients have had. The team still need to chase some people up for receipts etc., however the process is more efficient overall.

It’s easier for Bourke Group's clients to replace cards if required and very helpful that virtual cards are instantly available. Transaction visibility is no longer a problem as it’s instantly available to Bourke Group in each client's Budgetly dashboard.

One example of this is Bourke Group's yacht charter client that had a credit card shared amongst all staff making it difficult to get the card to people when they needed it.

With a high turnover due to staff often only staying on for a single charter, it was hard to track card purchases and subscriptions that staff signed up for.

The yacht charter company now has a single card just for subscriptions making it easy to monitor. The GST extraction automation has also saved a lot of time for Bourke Group as they no longer have to manually review each receipt.

"We’ve saved a few hours per week, per client. This time saved means we’re spending less time working on the admin in the background, so our clients are saving a large amount of money compared to what Budgetly costs"

Sheila Ryan, Head of Financial Operations

2. Real-time visibility on all transactions

Transactions including information such as who spent the funds, where the funds were spent, the budget the funds have been spent from, the accounting coding information, the receipt and GST information is all available in real-time.

“Seeing who’s made a transaction is no longer a problem as it’s instantly available to us."

Sheila Ryan, Head of Financial Operations

3. Instant card issuing

Previously, there was a lot of back and forth between Bourke Group and their clients to organise a new card. They would often have to triangulate information between three parties and the wait time could be weeks.

For some of Bourke Group's clients like their yacht charter company, physically issuing a card to staff was particularly troublesome. With Budgetly, they can now click 3 buttons and instantly issue a virtual card to any of their clients' staff, no matter where they are!

“It’s a lot easier to replace cards if required and very helpful that virtual cards are instantly available.”

Sheila Ryan, Head of Financial Operations

3. 10/10 support!

"When we need any help, we can call or email Budgetly and they always answer the phone or respond to emails very quickly. Most of our problems we can solve ourselves because it is so easy to use. We’ve all contacted Budgetly at some point and they’ve always been very helpful!”

Sheila Ryan, Head of Financial Operations

For more information on Budgetly and how we work for businesses, schedule a demo with us today, or watch a 10-minute recorded demo.

About Bourke Group

Bourke Group is an award winning boutique firm with approx. 60 staff founded in 1993 Based in Melbourne and regional VIC. Their core services include: Virtual CFO & Family Office Services, HNW Wealth Management and Corporate Advisory.

Bourke Group offer a contemporary approach with traditional values of honesty, integrity and hard work. They are sector agnostic but strong across food/agri, retail, family groups, professional services and technology.

About Budgetly

Budgetly is an Australian prepaid corporate card and expense management software provider. We’re committed to making expense management easy for all companies and improving their expense processes. Our service is adopted by many NDIS providers, aged care providers, charities, and businesses across Australia.