5 foolproof ways to prevent accidental personal expenses on company cards

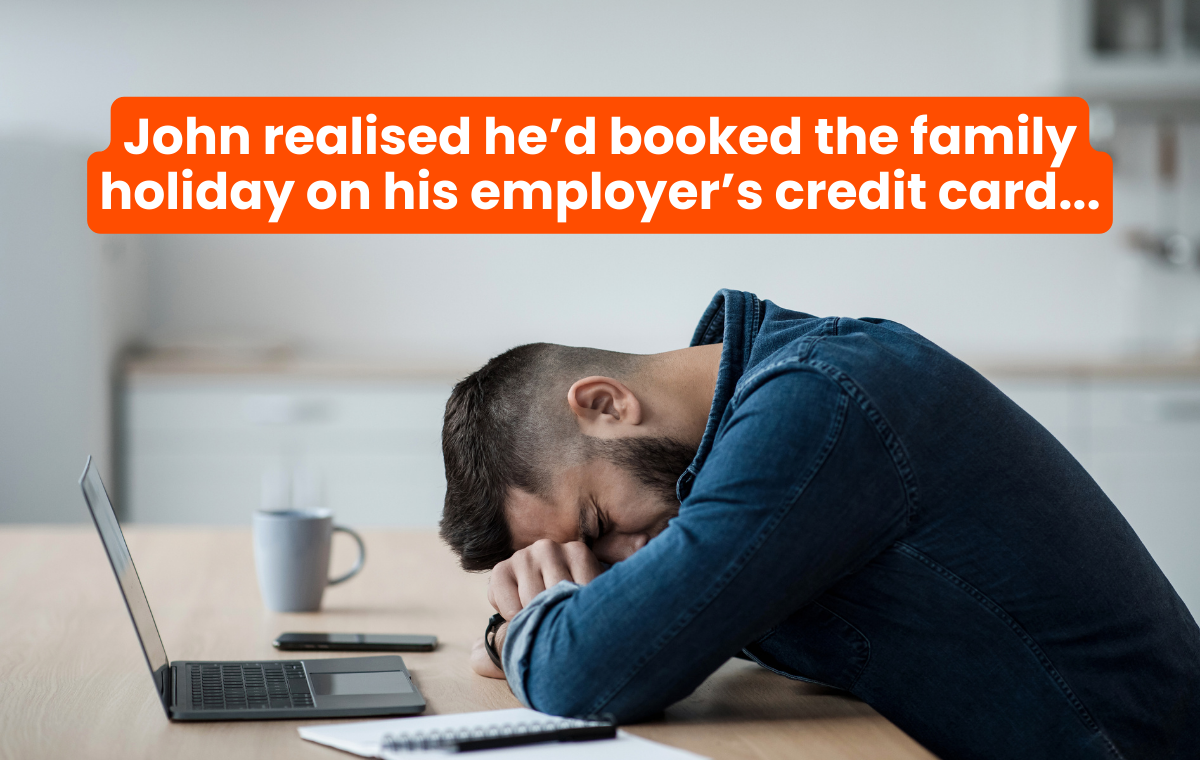

Consider a scenario where an employee, John, is planning a family vacation. While booking the flights, he accidentally uses his company-issued credit card instead of his personal credit card. An easy mistake when it’s not uncommon for us to have multiple credit cards!

These situations can lead to financial discrepancies, internal complications, and if it happens repeatedly or it was a large expense (like flights) it could even impact the company's overall financial health.

Potential issues that can arise when employees accidentally making personal purchases on company cards.

1. Financial discrepancies: As every expense needs to be recorded, and personal expenses will create discrepancies in a company's financial records. This can lead to challenges in reconciling accounts and will typically require additional time and resources to rectify.

2. Budget mismanagement: Budgets can be disrupted by non-business purchases, especially because they will be unplanned expenses which can cause financial strain; especially if budgets are tight.

3. Audit concerns: Improperly documented or unauthorised expenses may raise concerns during audits. Compliance with financial regulations and transparency in spending is crucial for maintaining a company's credibility.

4. Trust and accountability issues: Non-business purchases can erode trust between employers and employees, or at the very least, lead to some awkward conversations. An employer may be force to question an employee’s responsible use of company resources and adherence to company policies, even if it’s an honest mistake.

5. Time-consuming reconciliation: The personal expenses will be even more troublesome if there isn’t proper tracking and documentation. It will make reconciling a more time-consuming task for the finance team; time that could be better spent on more strategic financial activities.

How can we prevent these issues?

One of the most effective ways is to implement systems that allow employees to purchase autonomously – within budgets and spending rules – quickly upload receipts, add notes and track every transaction made with using their company cards.

5 ways to prevent accidental purchases (and make your expense management more efficient!)

1. Documentation: Being able to add notes to transactions seems like a small feature, but it provides a clear understanding of each expense. This type of documentation can be essential during audits or when reviewing financial statements, ensuring transparency and accountability.

2. Automatic tracking: Tracking all purchases automatically allows for efficient reconciliation of accounts. Finance teams can quickly identify any discrepancies, address them promptly, and maintain accurate financial records.

3. Policy enforcement: Having the ability to set budgets and spending rules, for departments or even individual cards, means that it’s easier to enforce company expense policies. This can also prevent simple mistakes, like when Bob accidentally tries to order his KFC for lunch on the company card – a spending rule can prevent the purchase from ever going through.

4. Training opportunities: Identifying non-business purchases provides opportunities for training and education. Employees can learn from their mistakes, and the company can use these instances to reinforce spending policies and guidelines.

5. Cost control: Monitoring all transactions helps in controlling costs. By having a complete overview of expenses, companies can identify areas where spending can be optimised or cut, contributing to better financial management.

Having a system in place that allows employees to add notes and tracks all purchases made with company cards is crucial for maintaining financial integrity, enforcing policies, and ensuring efficient reconciliation processes.

How to set-up an end-to-end expense management system!

Implementing Budgetly into your business will tick all of these boxes! The Budgetly cards and app are a powerful duo designed to seamlessly eliminate the headaches associated with accidental non-business purchases made with company cards. Here's how this dynamic solution can revolutionise your expense management:

✔︎ Smart expense tracking

With Budgetly cards, every transaction is automatically logged in real-time. The Budgetly app and dashboard provides a comprehensive overview of all purchases, making it easy to track and monitor expenses.

✔︎ Customisable spending limits

Budgetly cards allow administrators to set customisable spending limits for each card. This feature ensures that employees stay within designated budgets, reducing the risk of unplanned expenses.

✔︎ Instant notifications

The Budgetly app sends instant notifications for every transaction. This immediate feedback empowers management to catch and rectify any accidental non-business purchases before they become financial discrepancies.

✔︎ In-app transaction notes

Say goodbye to confusion with Budgetly's in-app note addition feature. Employees can add contextual notes to every transaction, providing a clear understanding of the purpose behind each expense.

✔︎ Policy enforcement

Budgetly cards and the app make policy enforcement easy. By tracking all purchases, the system reinforces spending policies, fostering compliance and accountability among employees.

✔︎ Automated reconciliation

Forget the hassle of manual reconciliation. Budgetly's automated system ensures that financial records are always up-to-date, saving valuable time for your finance team.

✔︎ Real-time insights

Gain valuable insights into your company's spending patterns with Budgetly's real-time reporting features. Identify areas for optimisation and strategic decision-making based on accurate, current data.

✔︎ Fraud prevention

Budgetly cards come equipped with advanced security features to prevent fraud (2FA & 256 bit encryption). Combined with the app's transaction monitoring, it creates a robust defence against unauthorised or fraudulent activities.

✔︎ Training opportunities

Accidental non-business purchases become learning opportunities. Budgetly's detailed tracking allows for targeted training and education, helping employees understand and adhere to company spending guidelines.

10. Financial well-being

Budgetly is not just about expense management; it's about promoting overall financial well-being. By providing a user-friendly and efficient solution, Budgetly cards and the app contribute to a healthier financial culture within your organisation.

👉🏼 Say goodbye to financial headaches and hello to an efficient expense management process with Budgetly cards and the Budgetly app.

It's time to embrace a new era of financial control and transparency!

If you’d like to eliminate receipt tracking dramas with instant budget allocation, automatic GST extraction and real-time reporting, then schedule a demo with us today, or watch a 10-minute recorded demo.